In this post, you will find a glossary of commercial real estate terminology so that you can learn the definitions of terms you may need to understand for a real estate transaction.

Absorption

The amount of inventory or units of a specific commercial property type that becomes occupied during a specified time period (usually a year) in a given market.

Acceptance

Agreeing to the terms of an offer, thereby creating a contract.

Accumulated cost recovery

Total cost recovery deductions taken throughout the holding period of a property.

Adjoining

In actual contact with another object (i.e., attached). Same as “Contiguous”.

Adjusted basis

The original cost basis of a property plus capital improvements, less total accumulated cost recovery deductions, and partial sales taken during the holding period.

Agent

An individual/entity who transacts, represents, or manages the business for another individual/entity. Permission is provided by the individual/entity being represented.

By Dmadeo (Own work) [GFDL or CC BY-SA 3.0], via Wikimedia Commons

The repayment of loan principal through equal payments over a designated period of time consisting of both principal and interest.

Annual debt service

The total amount of principal and interest to be paid each year to satisfy the obligations of a

loan contract.

Assessed value

The value of real property established by the tax assessor for the purpose of levying real estate taxes.

Assignee

Individual to whom a contract is assigned.

Assignment

The manner by which a contract is transferred from one individual to another individual.

Assignor

An individual who transfers a contract to another individual.

Base

A face, quoted, dollar amount representing the rate or rent in dollars per square foot per year and typically referred to as the base rate.

Build Out

The construction or improvements of the interior of a space, including flooring, walls, finished plumbing, electrical work, etc.

Building Permit

Written government permission to develop, renovate, or repair a building.

Cancellation Clause

A provision in a contract (e.g., lease) that confers the ability of one in the lease to terminate the party’s obligations. The grounds and ability to cancel are usually specified in the lease.

Capital Improvement

Any major physical development or redevelopment to a property that extends the life of the property. Examples include upgrading the elevators, replacement of the roof, and renovations of the lobby.

Capitalization Rate

The value is given to the property when the Net Operating Income (NOI) is divided by the current market value or sales price. A cap rate can be used as a rough indicator of how quickly an investment will pay for itself. The higher the cap rate, the better. Example: A property has an NOI of $100,000, and the price is $1,000,000. The cap rate would be 10% ($100,000/$1,000,000 = 10%). Based on this calculation, you would see a return in 10 years.

Certificate of Occupancy

The government issues this official form, which states that the building is legally ready to be occupied.

Chattel

Household goods, including personal property such as lamps, desks, and chairs.

Commercial Real Estate

Commercial Real Estate

Commercial real estate is property that is used solely for business purposes and that are commercial leased out to provide a workspace rather than a living space. Ranging from a single gas station to a huge shopping center, commercial real estate includes retailers of all kinds, office space, hotels, strip malls, restaurants and convenience stores.

Common area

For lease purposes, the areas of a building (and its site) that are available for the nonexclusive use of all its tenants, such as lobbies, corridors, and parking lots.

Common Area Maintenance (CAM)

This is the amount of additional rent charged to the tenant, in addition to the base rent, to maintain the common areas of the property shared by the tenants and from which all tenants benefit. Examples include snow removal, outdoor lighting, parking lot sweeping, escalators, sidewalks, skyways, parking areas, insurance, property taxes, etc. Most often, this does not include any capital improvements that are made to the property.

Commissions Split

An agreed upon division of commissions earned between a sales agent and sponsoring broker, or between the selling broker and listing broker. Example: The seller of a $1,500,000 building paid a $75,000 commission at closing. The commission split was 50/50 between the listing and selling brokers. Each broker then split the fee received with the sales agent responsible for the sale, in accordance with each firm’s commission split schedule.

Contiguous

Touching at some point or along a boundary

Contingency

A requirement in a contract that must occur before that contract can be finalized

Contract

A legal agreement between entities that requires each to conduct (or refrain from conducting) certain activities. This document provides each party with a right that is enforceable under our judicial system.

Cost approach

A method of determining the market value of a property by evaluating the costs of creating a property exactly like the subject.

Covenants

Wording found in deeds that limits/restricts the use to which a property may be put (e.g., no bars).

Deed

Deed

A signed, written instrument that conveys title to real property.

Deed Restriction

An imposed restriction in a deed that limits the use of the property. For example, a restriction could prohibit the sale of alcoholic beverages.

Failure to fulfill a promise, discharge an obligation or perform certain acts.

Transfer something from one entity to another.

Ejectment

Action to regain possession or real property. This is a last-ditch effort that is used when there is no relationship between landlord and tenant.

Eminent Domain

The government’s right to condemn and acquire property for public use. The government must provide the owner fair compensation.

Endorsement

Signing one’s name on the back of a check.

Escrow

A written agreement among parties, requiring that certain property/funds be placed with a third party. The object in escrow is released to a designated entity upon completion of some specific occurrence.

Estoppel Certificate

A legal instrument executed by the one taking out the mortgage (i.e., mortgagor). The owner of a property may require an individual leasing a property to sign an estoppel certificate, which verifies the major points (e.g., base rent, lease commencement, and expiration) existing lease between the landlord and tenant.

Eviction (Actual)

Physical removal of a tenant either by law or force.

Eviction (Constructive)

The landlord or his agents disturb the tenant, rendering the leased space unfit for the tenant’s previous use.

Eviction (Proceeding)

A legal proceeding by the landlord to remove a tenant

Exclusive Agency

Exclusive Agency

An agreement in which one broker has exclusive rights to represent the owner or tenant. If another broker is used, both the original and actual broker are entitled to leasing commissions.

Feasibility analysis

The process of evaluating a proposed project to determine if that project will satisfy the objectives set forth by the agents involved (including owners, investors, developers, and lessees).

Fiduciary

A person who represents another on financial/property matters.

Fixtures

Personal property so attached the land or building (e.g., improvements) it is considered part of the real property.

Flex space

Space that is flexible in terms of what it can be used for (for example, space that could be utilized for industrial or office activities).

Grace Period

Additional time allowed to complete an action (e.g., make a payment) before a default or violation occurs.

Gross Lease

A lease of property whereby the landlord (i.e., lessor) pays for all property charges usually included in ownership. These charges can include utilities, taxes, and maintenance, among others.

Highest and best use

The reasonably probable and legal use of vacant land or an improved property, which is physically possible, appropriately supported, financially feasible, and that results in the highest value.

Hard Money Loan

An asset-based loan in which a borrower receives funds that are secured by the value of a piece of real estate and often at a higher interest rate than a traditional commercial property loan. They are used for acquisitions, turnaround situations, foreclosures, and bankruptcies.

Holdover Tenant

A tenant who remains in possession of leased property after the lease term expiration.

Incompetent

An individual who is unable to handle his own affairs by reason of some medical condition (e.g., insanity, Alzheimer’s).

Industrial gap

The difference between the demand for an industrial property and the supply of that property in a given market or area.

Instrument

A written legal document created to secure the rights of the parties participating in the agreement.

Irrevocable

Incapable of being altered, changed, or recalled.

Joint Tenancy

Joint Tenancy

Ownership of real property by two or more individuals, each of whom has an undivided interest with the right of survivorship.

Judgement

A formal decision issued by a court relating to the specific claims and rights of the parties to an act or suit.

Landlord

One who rents property to a tenant.

Lease

A contract whereby the landlord grants the tenant the right to occupy defined space for a set period at a specific price (i.e., rent).

Lease buyout

The process by which a landlord, tenant, or third party pays to extinguish the tenant’s remaining lease obligation and rights under its existing lease agreement.

Leasehold

The estate or interest a tenant has as stated in the tenant’s lease.

Lessee

An individual (i.e., tenant) to whom property is rented under a lease.

Lessor

An individual (i.e. landlord) who rents property to a tenant via a lease.

Letter of Intent

An informal, usually non-binding, agreement among parties indicating their serious desire to move forward with negotiations.

Listing

An employment contract between principal and agent that authorizes the agent (such as a broker) to perform services for the principal and his property.

Loss Factor

What percentage of the gross area of a space is lost due to walls, elevator, etc. Rule of thumb in Manhattan is approximately 15%

Mandatory

A requirement that must be conformed to as specified in any written document.

Market Price

The actual selling or leasing price of a property.

Market Value

Market Value

The expected price that a property should bring if exposed for lease in the open market for a reasonable period of time and with market savvy landlords and tenants.

Meeting of the Minds

When all individuals to a contract agree to the substance and terms of that contract.

Minor

A person under a legal age, usually under 18 years old.

Multiple Listing

An arrangement among Real Estate Board of Exchange Members, whereby each broker presents the broker’s listings to the attention of the other members so that if a lease results, the commission is divided between the broker bringing the listing and the broker making the lease.

Net Lease

Also called triple net lease. The lessee pays not only a fixed rental charge but also expenses on the rented property, including maintenance. Example: Super Saver Markets enters into a triple-net lease. They are to pay for all the taxes, utilities, insurance, repairs, janitorial services, and license fees; any debt service and the landlord’s income taxes are the responsibility of the landlord.

Non-Disturbance Agreement

The tenant signs this to prevent himself from being evicted if the property owner does not pay its mortgage to the bank.

Notary Public

A public officer who is authorized to witness and verify certain documents (e.g., contracts, deeds, mortgages). Also an affidavit may be sworn before this public officer.

Obligee

The person who will receive the outcome of an obligation.

Obligor

An individual who has engaged to perform an obligation to another person (i.e., obligee).

Open Listing

A listing is given to any broker without liability to compensate any broker except the one who first secures a buyer who is ready, willing, and able to meet the terms of the listing, or secures the acceptance by the landlord of a satisfactory offer; the lease of the property automatically terminates the listing.

Option

A right is given to purchase or lease a property upon specified terms within a specified time. If the right is not exercised, the option holder is not subject to liability for damages. If the holder of the option exercises it, the grantor of the option must perform the option’s requirements.

Percentage Lease

A lease of property in which the rent is based upon the percentage of the sales volume made on the specific premises. There is usually a clause for a minimum rent as well.

Personal Property

Personal Property

Any property which is not real property. Examples include furniture, clothing, and artwork.

Power of Attorney

A written instrument duly signed and executed by an individual which authorizes an agent to act on his behalf to the extent indicated in the document.

Principal

The employer (e.g., landlord) of an agent or broker. This is the agent’s or broker’s client.

Quiet Enjoyment

The right of a landlord or tenant to use the property without disturbances.

Real Estate Board

An organization whose members consist primarily of real estate professionals such as brokers.

Related: Real Estate Law Attorney

Real Estate Syndicate

When partners (either with or without unlimited liability) form a partnership to participate in a real estate venture.

Real Property

Land and any capital improvements (e.g., buildings) erected on the property.

Realtor

A coined word which may only be used by an active member of a local real estate board, affiliated with the National Association of Real Estate Boards.

Rent

Compensation from tenant to landlord for the use of real estate.

Rent concession

A period of free rent given to the tenant by the lessor.

Rent escalators

Items specified in a lease such as base rent, operating expenses, and taxes that may increase by predetermined amounts at stated intervals or by a constant annual percentage.

Restriction

A restriction, often specified in the deed, on the use of a property.

Revocation

An act of rescinding power previously authorized.

Rule of Thumb

A common or ubiquitous benchmark. For example, it is often assumed that each worker in an office will need approximately 250 square feet of space.

Situs

Situs

The location of a property; the place to which, for purposes of legal jurisdiction or taxation, a property belongs.

Specific Performance

When a court requires a defendant to carry out the terms of an agreement or contract.

Square Feet

The usual method by which rental space is defined. It is the area of that space, calculated by taking length times width. For example, a room 30 feet by 60 feet has an area of 1,800 square feet.

Statute

A law established by an act of the legislature.

Statute of Frauds

State law (founded on ancient English law) which requires that contracts must be reduced to written form if it is to be enforced by law.

Statute of Limitations

A law barring all right of redress after a certain period of time from the moment when a cause of action first arises.

Subagent

An agent of an individual already acting as an agent of a principal.

Sublease/Subletting

A lease in which the original tenant (lessee) sublets all or part of the leasehold interest to another tenant (known as a subtenant) while still retaining a leasehold interest in the property.

Subscribing Witness

The witness to the execution of an instrument who has written his name as proof of seeing such execution.

Sunk costs

Investment costs that are committed and cannot be recovered.

Surrender

The cancellation of a lease by mutual consent of the tenant and the landlord.

Tenant

A person or entity who has possession of the property though a lease.

Tenancy at Will

A license to occupy or use lands and buildings at the will of the landlord.

Tenancy by the Entirety

An estate which exists only between husband and wife. Each has equal right of enjoyment and possession during their joint lives, and each has the right of survivorship.

Tenant Improvements

Work done on the interior of a space can be paid for by the landlord, tenant, or some combination of both, depending on the terms of the lease.

Tenancy in Common

Ownership of property by two or more individuals, each of whom has an undivided interest, without the right of survivorship.

Tenants at Sufferance

An individual who comes to possess land via lawful title and keeps it in perpetuity without any title.

Tie-in Arrangement

Tie-in Arrangement

A contract where one transaction depends upon another transaction.

Tort

A wrongful act or violation of a legal right for which a civil action will lie.

Triple Net Lease

A lease requiring tenants to pay all utilities, insurance, taxes, and maintenance costs.Example: Super Saver Markets enters into a triple-net lease. They are to pay for all the taxes, utilities, insurance, repairs, janitorial services, and license fees; any debt service and the landlord’s income taxes are the responsibility of the landlord.

Urban Property

Property in a city or a high-density area.

Vacancy

The number of units or space (of a specific commercial type) that are vacant and available for occupancy at a particular point in time within a given market.

Valid

A binding situation that is authorized and enforceable by law.

Valuation

Estimated price, value, or worth. Also, the act of identifying a property’s worth via an appraisal.

Variable expenses

Costs, such as utilities, that vary with a building’s occupancy rate.

Variance

Government authorization to use or develop a property in a manner which is not permitted by the applicable zoning regulations.

Violation

Act, condition, or deed that violates the permissible use of the property.

Void

Something that is unenforceable.

Voidable

A situation which is capable of being unenforceable but is not so unless direct action is taken.

Waiver

The intentional relinquishment or abandonment of a specific claim, privilege, or right.

Work Letter

An amount of money that a landlord agrees to spend on the construction of the interior of a space per the lease, usually negotiated.

Zone

An area, delineated by a governmental authority, which is authorized for and limited to specific uses.

Zoning Ordinance

A law by a local governmental authority (city or county) that sets the parameters for which the property may be put to use.

We hope you have found this glossary of commercial real estate terms helpful.

* Advertising Material: To the extent that the information in this post is interpreted as attorney advertising in accordance with the Illinois Rules of Professional Conduct or within the meaning of state bar rules from all other localities, this statement is made pursuant to those rules.

Specialties: Specialization claims are prohibited by Illinois Supreme Court Rules and we do not claim to be specialists. The content of this e-mail is organized and presented for the sole purpose of general information. None of the included content should be construed as legal advice. Viewing this e-mail or e-mailing the account holder does not create an attorney-client relationship. NOTICE: This page may be considered advertising material.

The Law Offices of Lora Fausett P.C. provides real estate attorney services including loan modifications, buying and selling legal assistance, short sales and deeds in lieu, mortgage foreclosure defense, and others.

The Law Offices of Lora Fausett P.C. provides real estate attorney services including loan modifications, buying and selling legal assistance, short sales and deeds in lieu, mortgage foreclosure defense, and others.

Located in Glen Ellyn, Illinois and serving clients in DuPage, Cook, Kane, Will, and Kendall Counties.

For Information Call 630-858-0090

Sources: Wikipedia – LoopNet – Colliers –

The Law Offices of Lora Fausett P.C. provides real estate law services including loan modifications, buying and selling legal assistance, short sales and deeds in lieu, mortgage foreclosure defense, and more.

The Law Offices of Lora Fausett P.C. provides real estate law services including loan modifications, buying and selling legal assistance, short sales and deeds in lieu, mortgage foreclosure defense, and more.

DATE:

DATE:

William and Nancy Skog dreamed of retirement in a riverfront home in Wilmington, IL.

William and Nancy Skog dreamed of retirement in a riverfront home in Wilmington, IL. Scam artists are hacking into the email accounts of title companies, real estate agents and home buyers in search of home purchases with upcoming payments.

Scam artists are hacking into the email accounts of title companies, real estate agents and home buyers in search of home purchases with upcoming payments. Never wire money based on an email without verifying the transaction over the phone with your attorney or title company first.

Never wire money based on an email without verifying the transaction over the phone with your attorney or title company first.

Commercial Real Estate

Commercial Real Estate Deed

Deed Exclusive Agency

Exclusive Agency Joint Tenancy

Joint Tenancy Market Value

Market Value Personal Property

Personal Property Situs

Situs Tie-in Arrangement

Tie-in Arrangement

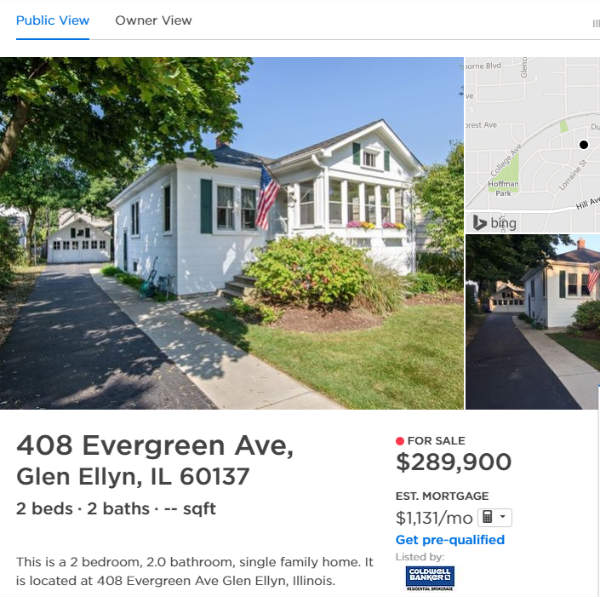

The case went before a federal judge in Chicago and was dismissed on August 23rd on the grounds that Zestimates are a mere “starting point” that are unlikely to confuse homebuyers.

The case went before a federal judge in Chicago and was dismissed on August 23rd on the grounds that Zestimates are a mere “starting point” that are unlikely to confuse homebuyers. The plaintiffs

The plaintiffs